SEBI by way of an interpretative letter dated October 13, 2023 (which was made public by SEBI on January 15, 2024) (‘IG’), has provided informal guidance regarding the interpretation of contra trade restrictions under the SEBI (Prohibition of Insider Trading) Regulations, 2015 in the matter of Share India Securities Limited (‘SISL’). On March 24, 2023, SISL had, through a rights issue, offered eligible shareholders: (i) equity shares; and (ii) 17 detachable warrants (‘Rights Allotment’). These warrants could be exercised (into equity shares of SISL) anytime within 18 months from allotment. The IG clarifies the applicability of contra trade restrictions on transactions involving the conversion of warrants into equity shares and the subsequent sale of these shares. Set out below are the queries raised in the IG and SEBI’s response to the queries:

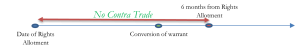

i. Conversion Prior to Expiry of Six Months from Rights Allotment: Whether conversion of warrants prior to expiry of six months from the allotment of rights securities will be hit by contra trade restrictions?

SEBI’s Position: Conversion of warrants into equity shares is not a corporate action. Conversion happens pursuant to a voluntary action by the warrant holder. Therefore, exercise of warrants will be deemed as acquisition of securities, which is a buy trade and, hence, no contra-trade issue with respect to allotment of shares under the rights issue, as that would also be a buy trade.

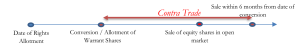

ii. Sale Prior to Conversion: Will any sale of equity shares in the open market, prior to the expiry of six months from the date of conversion, be hit by contra trade restrictions?

SEBI’s Position: Conversion of warrants into equity shares is a buy trade. Therefore, any sale of shares prior to expiry of six months from the date of conversion will attract contra-trade restrictions.

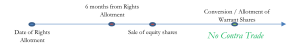

iii. Sale Post Expiry of Six Months from Rights Allotment: If after six months of allotment of rights securities, a shareholder sells its shares in the open market and uses the proceeds for conversion of the warrants, will this transaction be considered as contra trade?

SEBI’s Position: SEBI noted that conversion of warrants will occur at a pre-determined price at the option of the warrant holder. Therefore, conversion of warrants prior to expiry of six months from a previous sale transaction in the open market will not attract contra trade restrictions. However, a subsequent sale transaction after allotment of shares pursuant to conversion of warrants will attract contra-trade restrictions.