The Reserve Bank of India (“RBI”) has brought all entities that facilitate cross-border payments for import and export of goods and services in online mode, namely ‘Payment Aggregator – Cross Border’ (“PA-CB”) under its direct regulation, through its circular ‘Regulation of Payment Aggregator – Cross Border’ (“Regulations”), issued on October 31, 2023.

Categories: PA-CB activities are classified into the following 3 categories: (a) export only PA-CB; (b) import only PA-CB; and (c) export and import PA-CB.

Authorisation: All non-bank entities that propose to undertake PA-CB services, including the entities that currently provide PA-CB services, will require an authorisation from the RBI as a payment system operator (PSO) under the Payment & Settlement Systems Act, 2007. All entities that currently undertake PA-CB services are required to apply for such authorisation by April 30, 2024. Such PA-CB’s can continue these activities until RBI has made a decision on their application. However, authorised dealer category – I scheduled commercial banks (“AD Banks”) do not require separate approval for undertaking PA-CB activity from the RBI.

Non-bank payment aggregators (“PAs”) that are presently engaged in any PA-CB activities are required to intimate the RBI about their preference to continue with the PA-CB activities within 60 days from the date of the Regulations (i.e., October 31, 2023) prior to seeking approval for such activities from the RBI. Also, the Regulations clarify that PA-CBs authorised for a particular activity (for example, for imports transactions) will require a prior approval for undertaking an additional activity (for export transactions).

Key Requirements:

Some of the key compliance requirements prescribed under the Regulations are discussed below:

1. Net-worth requirement: The PA-CBs must maintain the minimum net-worth as per the below tabulation:

| Net Worth (in INR) | Existing non-bank PA-CB | New non-bank PA-CB |

| 15 crores | At the time of submission of application for authorisation. | |

| 25 crores | March 31, 2026 | End of 3rd financial year from grant of authorisation |

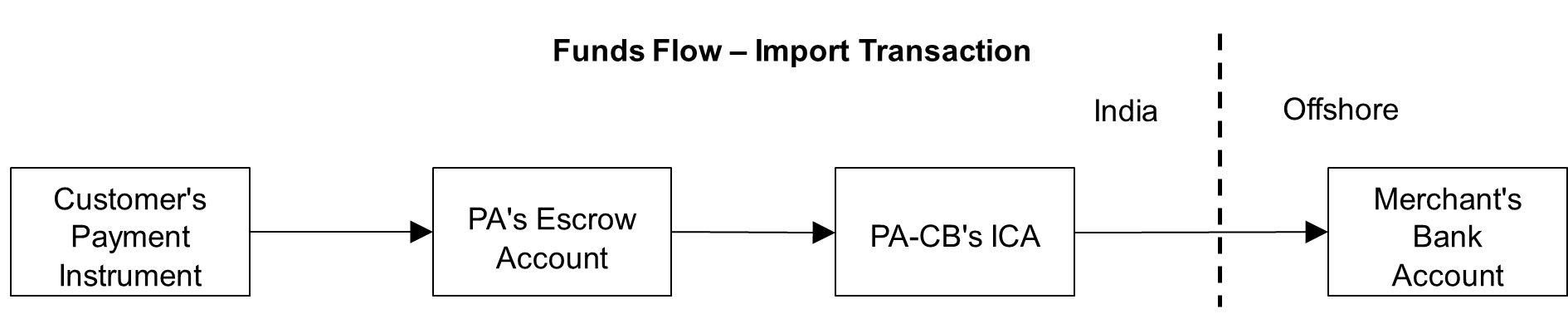

2. Import PA-CBs: Import only PA-CBs are required to maintain an Import Collection Account (“ICA”) with an AD Bank. Payments for import transactions collected from customers need to be received in an escrow account of the PA from where monies need to be transferred to the ICA for onward settlement to the offshore merchants. A diagrammatic representation of the funds-flow for import transactions is set out below:

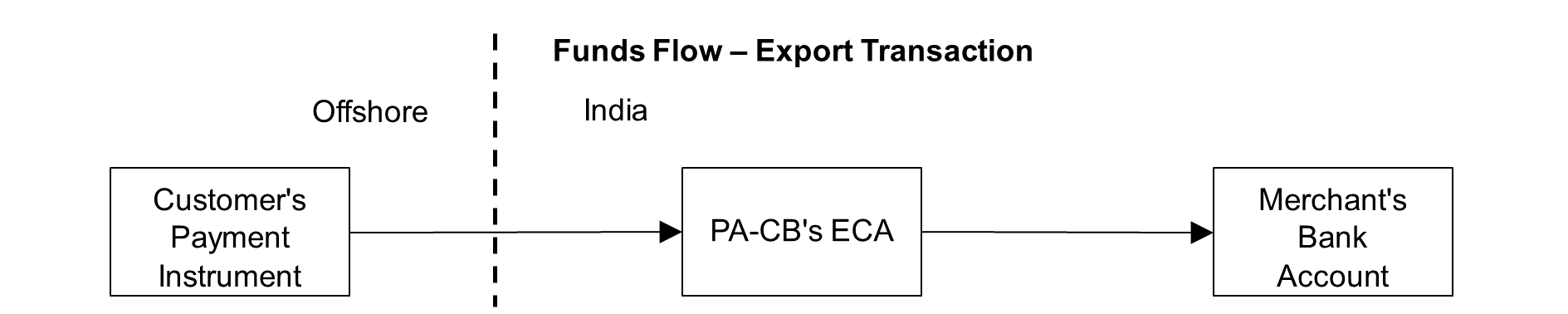

3. Export PA-CBs: Export only PA-CB need to maintain an Export Collection Account (“ECA”) with an AD Bank. The ECA may be denominated in INR or foreign currency (for which separate currency accounts are required to be maintained). An export PA-CB can undertake settlement in currencies other than INR only for merchants that are directly on-boarded by it. A diagrammatic representation of the funds-flow for export transactions is set out below:

4. Customer Due Diligence and KYC: PA-CBs are mandated to undertake customer due diligence for the purposes of the KYC in accordance with the Master Directions on Know Your Customer, 2016, of the merchants on-boarded by it, which includes merchants that are directly on-boarded, e-commerce marketplaces or entities providing PA services. Further, in case of import transactions, PA-CBs must also undertake due diligence of buyer that import goods or services more than INR 2,50,000 per unit.

5. Payment Instruments: For import transactions, the Regulations permit use of any payment instrument issued by an authorised payment system, except small-PPIs (prepaid payment instruments).

6. FIU-Ind: All non-bank PA-CBs are required to register with the Financial Intelligence Unit – India (FIU-IND), prior to seeking authorisation from the RBI.

7. Foreign Trade: The PA-CB need to ensure that payment transactions for any restricted or prohibited goods or services (under the extant Foreign Trade Policy) are not facilitated.

8. Domestic PA activity and PA-CB activity: Entities involved in domestic PA as well as PA-CB activities must keep ICA and ECA separate from escrow account for PA activity.

9. Transaction Limit: PA-CBs are permitted to process payments for an import or export transaction up to a maximum of INR 25,00,000 per unit of goods or services.

Besides the above, the PA-CBs are required to ensure compliance with the guidelines on governance, merchant on-boarding, permissible debits and credits (these apply to ICA and ECA), customer grievance redressal and dispute resolution framework, baseline technology recommendations, security, fraud and risk management framework, as prescribed under the Guidelines on Regulation of Payment Aggregators and Payment Gateways applicable to PAs for domestic transactions by January 31, 2024.