Private Market Investments will account for over 10% of asset allocation for family offices in 5 years

- The Private Market Monitor is a survey of over 100 family offices and UNIs launched by trica in partnership with AZB & Partners and EY

- 75% investors see direct startup investments as the highest conviction opportunities in the next 3-5 years

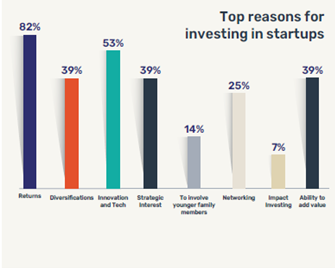

- 82% family offices chose non-linear returns as the top reason for participating in startup investments

Mumbai, December 17, 2021 – Over 40% family offices have doubled their allocation to private markets in the past five years and the interest of large cheque writers is increasing to have a direct participation in a startup’s capitalisation table according to The Private Market Monitor. The first edition of the report produced by trica in partnership with AZB & Partners and EY brings together historical trends in this space that delves into the decision-making process and highlights how investments are evolving in India’s private market.

The report finds that the changing face of the startup ecosystem with the spate of initial public offerings and acquisitions has created a new category of first generation UHNIs that are proactively exploring the family office route to manage their wealth.

Download: The Private Market Monitor Report

I] Asset allocation: The growing importance of startup investments

Private market investments remain the alternative investment of choice with allocations to startups and VC funds comprising 18% of the overall pie. This is quite aggressive when compared to a 15% allocation to other alternatives (real estate, infrastructure, art, etc.), 20% allocated to fixed income and 36% to listed equities. Over 83% family offices have an allocation to private markets which is over 10% of their overall asset distribution and this number has been steadily increasing over the past five years for 50% and has doubled for 40% of the participants.

II] Access matters: Growing propensity to invest directly into startups

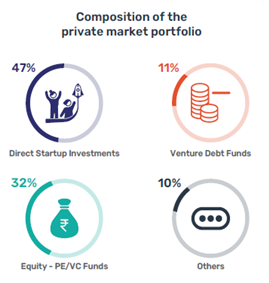

The private market portfolio of respondents comprised of

47% direct startup investments, 32% exposure to VC/PE funds and 11% to venture debt funds. The top factors investors evaluated to make direct startup investments was quality of top management, high growth market opportunity and the presence of a strong business moat.

III] Risk and rewards: Time is ripe to seek a cross stage exposure

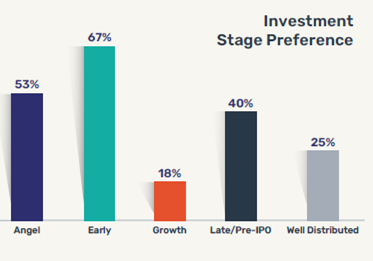

50% of family offices surveyed preferred the seed to Series A stage to enter a startup investment, 40% preferred late to pre-IPO transactions while 25% stated a preference for having a well distributed portfolio across stages. In addition to this, most investors took a favourable view on the exit scenario with 36% and 32% in the optimistic and neutral zone and 28% having some concerns.

IV] Building stacks: Fintech and enterprise SaaS

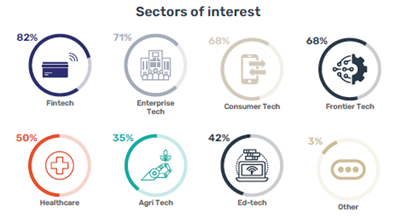

Fintech (82%) and enterprise tech (71%) were the top two sectors of choice by a clear majority, followed by other sectors such as Consumer Tech (68%), Healthcare (50%), Agritech (35%), EdTech (42%).

Commenting on the launch of the report, Nimesh Kampani, Co-founder and CEO of trica said, “The rapid expansion of UHNIs and family offices in India coupled with the positive exit scenario for startup investments in the last year has led to a growing appetite among investors to more actively manage their private market portfolios. The inclination of family offices to opt for direct startup investments is a sign of maturity of the asset class and also reflects well on the contribution on platforms like LetsVenture and trica that are democratising access and eliminating information arbitrage.”

“As recently as a decade ago, it was commonplace to find UHNIs and well-known business families with no comprehensive plan for their personal wealth, often with unfortunate consequences. Thankfully, the tide is now shifting as has been illustrated in ‘The Private Market Monitor’. As family offices take a better organised and concerted view of building and preserving their assets, this report is a comprehensive guide on understanding and allocating capital to private market opportunities,” Zia J. Mody, Co-founder and Managing Partner, AZB & Partners.

“2021 was an exceptional year for the startup space with over 50% of unicorns being created in India. Perceiving these market dynamics, we took the opportunity to partner with trica for preparing ‘The Private Market Monitor’ on how Family Offices and UHNIs in India are allocating their assets in the private market and their major concerns. The report brings together historical trends, delves into the decision-making process, and highlights how investments are evolving in the private market,” Sudhir Kapadia, EY India Tax Leader.

About trica

trica is a LetsVenture company that creates software products for equity management and transactions. trica equity (erstwhile MyStartupEquity) is a SaaS product for cap table and ESOP management with 350+ customers from India, Singapore, and USA. trica capital is a platform for UHNIs and family offices to back growth stage companies and funds. This is a venture-backed company whose investors include Accel, LC Nueva AIF* and Secocha Ventures. LetsVenture, founded in 2013 is India’s most trusted and active platform for startup investments with 7000+ angel investors, a portfolio value of over $3 billion and an Angel AIF with an AUM of over $64 million.

About AZB & Partners

AZB & Partners, one of India’s premier law firms was founded in 2004 with a clear purpose to provide reliable, practical and full–service advice to clients, across all sectors. Having grown steadily since its inception, AZB & Partners now has offices across Mumbai, Delhi, Bangalore, and Pune with over 450+ lawyers. The Firm’s private client practice comprises a dedicated team of senior professionals assisting leading business families, family offices and HNWIs with their personal planning. They advise on intra-family wealth transfers, family disputes, group re–organizations, cross–border planning, collectibles and high–value philanthropic bequests. The team seamlessly leverages other practices of our full–service firm to offer tailored advice to all our clients, while continuing to act as the relationship contact for the family enabling them to bring in a depth of expertise that may not be available to advisors with a more limited focus and provide specialist advice in areas such as real estate, securities law, intellectual property, disputes, forensics, and tax law. Our clients appreciate our ability to address their needs holistically, which has resulted in the development of lasting relationships. The Firm is widely acknowledged for its Private Client expertise and has been ranked as a tier 1 firm by leading reviews such as the Chambers High Net Worth and the Legal 500 Asia-Pacific Guides.

About EY

EY exists to build a better working world, helping create long-term value for clients, people and society and build trust in the capital markets. Enabled by data and technology, diverse EY teams in over 150 countries provide trust through assurance and help clients grow, transform and operate. Working across assurance, consulting, law, strategy, tax and transactions, EY teams ask better questions to find new answers for the complex issues facing our world today. As trusted advisors to ambitious business-owning families, including more than 80% of the world’s top 500 family enterprises, EY teams have the experience and know- how to help the entire family enterprise — families, their family business and their family office — pursue growth opportunities while preserving values and building the family legacy. Drawing from more than 100 years of experience supporting the world’s most entrepreneurial families, EY Family Enterprise professionals are experienced in pinpointing and helping to optimize the drivers that impact family businesses’ growth and longevity, preserve wealth and culture, and solidify multigenerational legacies.

Download: The Private Market Monitor Report